The recent news around China limiting exports of key antimony ore and metal products has put this rarely discussed but strategically important element into the spotlight. The limits, effective from September 2024, apply to six kinds of antimony-related products, including antimony ore, antimony metals and antimony oxide. The rules also ban the export of gold-antimony smelting and separation technology without permission.

Over the past decade Core Resources has worked on numerous antimony projects, both domestically and internationally, and has developed specialist expertise in the processing of antimony ore and production of the various end products.

Antimony Market Supply

Currently, major production countries of antimony include China, Bolivia, Russia and Tajikistan, whose annual antimony output in aggregate amount to over 95% of the global total. Last year China alone accounted for 48% of the globally mined output of antimony1 and as such has been the key supply moderator during demand declines. Further pressure on the supply ex-China was also assisted by the recent closure of 3 mines below.

These significant previous western producers are currently not producing antimony:

- Beaver Brook – closed in 2013 (capacity ~6,000 tpa Sb)

- Consolidated Murchison (now Stibium Mopani) – closed 2014 (capacity ~6,000 tpa Sb)

- Hillgrove Mine – closed in 2015 again after a short restart (capacity ~5,000 tpa Sb)

In addition, since 2016 the supply side of the market has been impacted by environmental pressures from the Chinese central government to improve environmental performance of existing producers in the areas of waste gas, slag and water emissions. Significant shutdowns have occurred until rectification works are completed, but a number of smaller plants will be unlikely to come back into production.

Antimony Production

Based on production volume, in 2018 almost 70% of antimony was mined as by- or co-product, indicating a high supply risk2. Antimony is typically a by-product of gold mining, as is the case for Russian gold producer Polyus and their Olympiada mine3, which is the world’s largest antimony mine.

Antimony is typically produced by one of two process routes – flotation followed by roasting, or through the hydrometallurgical Alkaline Sulphide Leach (ASL) process coupled with electrowinning.

Flotation-Roasting

Flotation of antimony minerals, primarily Stibnite SbS3, to produce an antimony concentrate containing greater than 60% Sb. This concentrate is typically sent to antimony refiners whereby the concentrate is roasted to generate high purity antimony trioxides, Sb2O3 which are a key antimony product. This process route also includes where antimony is floated as a by-product contained with gold concentrates, which are sent to antimony smelters which can process gold and antimony concentrates. Projects using this approach are:

- Polyus – Olympiada

- Larvotto Resources – Hillgrove PFS proposed route

- Mandalay Resources Corporation – Costerfield

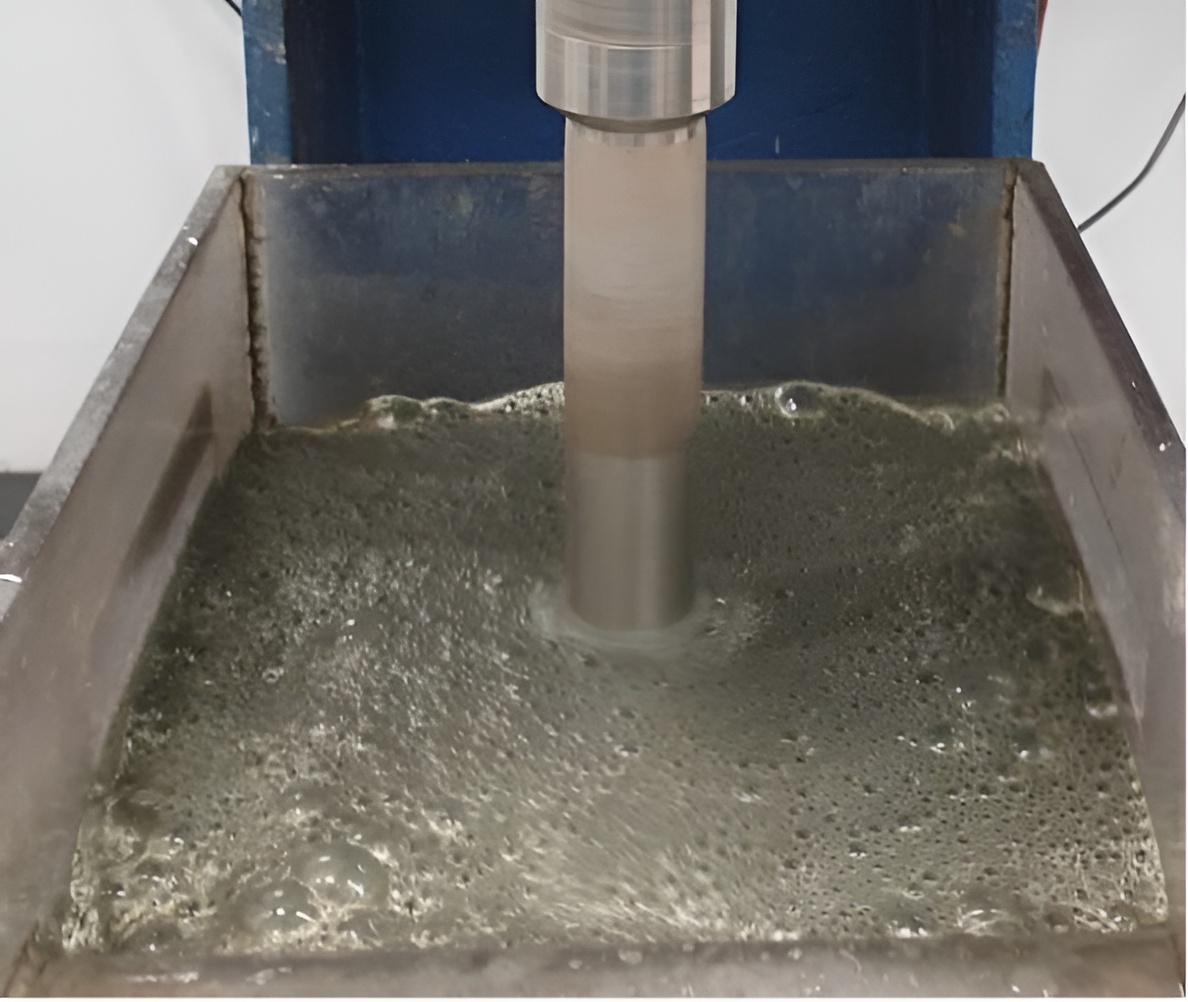

ASL Process

Direct leaching of antimony from suitable minerals such as Stibnite and Jamesonite, typically via an Alkaline Sulphide Leach. The antimony can then be recovered from the leach liquor, typically by electrowinning to form antimony cathode. Projects using this approach are:

- Straits Resources – Hillgrove production 2008-09

- Sunshine Antimony Refinery

Core has extensive testwork and flowsheet development experience across both antimony production routes. A few recent case studies are presented below.

Technical support – confidential project

Core carried out a large program of technical support to recover antimony as cathode via the ASL process from Stibnite ore. The program was extensive, and included:

- Technical review of site process, historic metallurgy and technical documentation

- Review of global practices in antimony production and benchmarking for the site

- Development of a research program to optimise the selected antimony recovery process, being ASL with electrowinning

- On-site supervision support to the research program

- Antimony product market analysis – product specifications, production pathways and market

- Recommendations for design of the antimony refining facility

- Flowsheet options review

Figure 1: High Purity Antimony Cathode Generated from ASL Process

Recovery of Antimony from tailings in Stibium Mopani Mine, South Africa

Core carried out testwork and flowsheet development to recover antimony via the ASL process from low-grade stockpiled antimony containing tailings. This work included upgrading via flotation and classification, leach testwork and precipitation testwork to generate saleable antimony precipitates. See Core’s case study here.

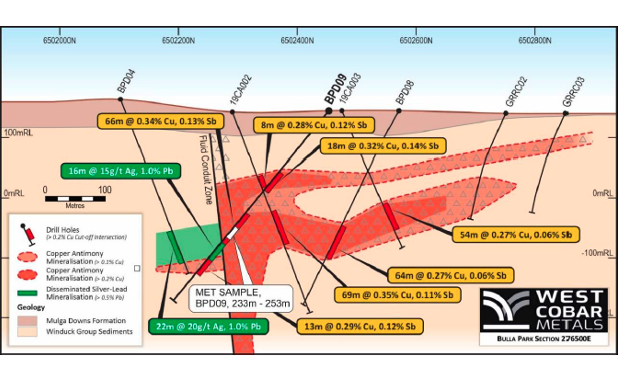

Flowsheet design and testwork for antimony developer, Tasmania

Core completed flowsheet design, testwork and engineering for an antimony explorer/developer in Tasmania. This work involved developing a novel approach to recovering antimony from an uncommon mineral, Jamesonite, whilst recovering by-products lead and silver in a low-cost and straightforward process flowsheet that could be implemented on site using readily available equipment.

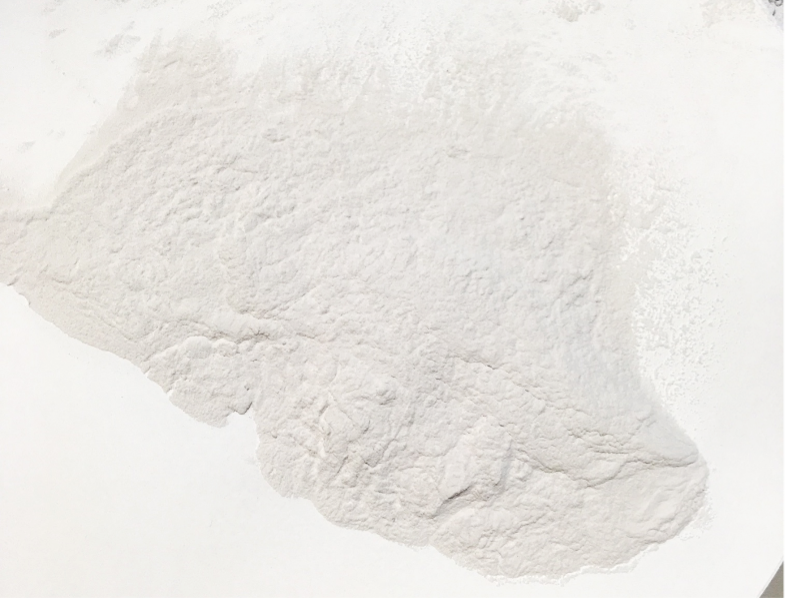

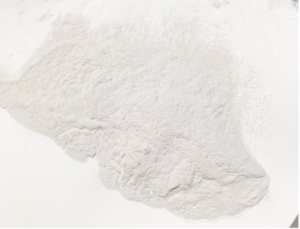

Figure 2: High Purity Antimony Oxide Generated from ASL Process.

To find out more about how Core can assist with the removal of antimony and other impurities, read here.

1 https://edition.cnn.com/2024/08/15/tech/china-antimony-export-ban-intl-hnk/index.html

2 https://www.sciencedirect.com/science/article/pii/S0921344922004219?via%3Dihub